How do I Change Address with IRS.

With the second spherical of stimulus checks arising, it’s vital to make sure the IRS is aware of the precise place to ship yours. If you misplace your stimulus test, or it will get misplaced into the USPS-ether, getting it changed could be a headache — and no person wants more of those in these taxing (no pun meant) and irritating instances. Down under we’ll run you thru precisely how to vary deal with with the IRS so you possibly can relaxation assured that your stimulus test is on its means to the doorstep.

How do I Change Address with the IRS

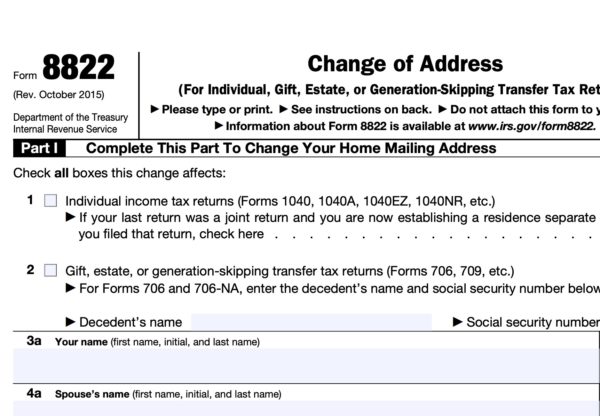

In order to inform the IRS of a change in deal with, you have to fill out a Form 8822, together with your up to date info, after which make sure you ship it to the right IRS processing middle (more on that under).

1. Head over to IRS.GOV

To discover the newest revision of Form 822, head right here to the Form 822 About Page or click on right here to go direct to the present PDF circa January 2021.

2. Fill out the Form 8822

For the overwhelming majority of people trying to merely update their deal with for both Stimulus-check enterprise or their tax returns, you’re going to need to test the field in Line 01 indicating this your new deal with in relation to your yearly 1040 tax returns.

In Line 3A, Remember to embrace any vital suffixes to your full title, akin to “Jr”, “Sr”, or “III”.

If neither you nor your partner has modified your title because you final up to date your IRS info, you possibly can skip 5a and 5b.

Line 6a is the place you’ll embrace your earlier deal with, together with the road, residence quantity, metropolis/city, state and ZIP code.

Line 7 is the place you’ll enter your new deal with, with the entire aforementioned particulars from avenue to ZIP code.

It’s advisable to incorporate a phone quantity initially of Part III in case the IRS must contact you about something having to do together with your deal with change.

Review your Form 8822, ensuring the entire info is right, and signal and date it.

3. Send it to the CORRECT Filing Center

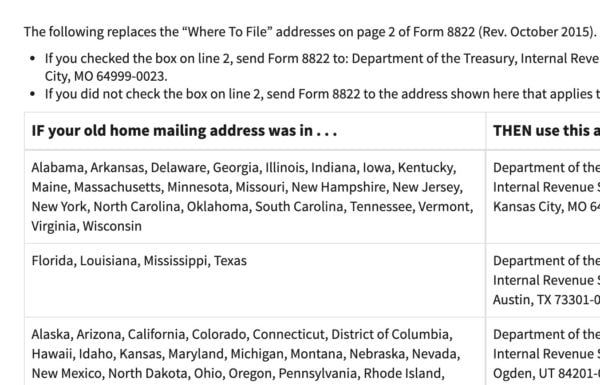

The particular IRS submitting location you have to ship your Form 8822 varies by state and is determined by your earlier location. On web page 2 you will see some more common info to the 8822 and, importantly, a breakdown of IRS submitting facilities by state. You can learn one other iteration of the identical info on the IRS web site right here.

NOTE: The submitting middle you have to ship it to is to your OLD deal with, not your new one. For instance, for those who moved from Florida to Colorado you would need to ship your Form 822 to the IRS Office in Austin, Texas.

And there you go! That’s all the pieces you have to make sure the IRS is aware of the place to ship your stimulus checks. If you will have any additional questions, be at liberty to ask us down under — we’re all the time prepared to assist.

Check out more article on – How-To tutorial and latest highlights on – Technical News

Leave a Reply